🔷 Introduction

In managerial decision-making, understanding how sales revenue interacts with cost behavior is crucial. One key metric that helps managers assess profitability and make informed decisions is the P/V Ratio. This ratio provides insight into the relationship between sales, variable costs, and contribution, ultimately influencing a firm’s profitability.

🔷 Definition of P/V Ratio

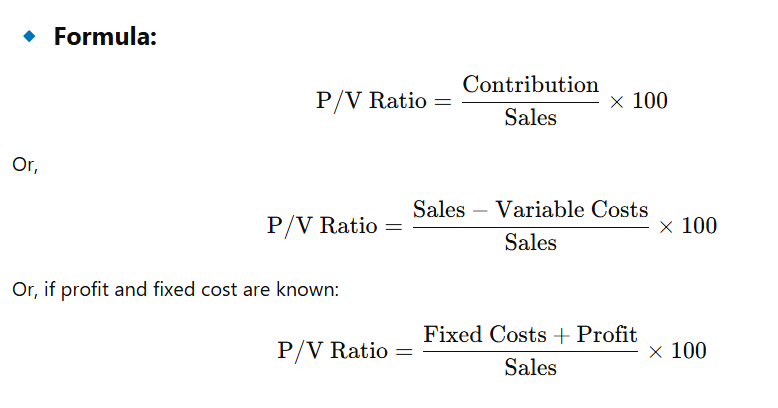

The Profit/Volume Ratio (P/V Ratio) is defined as the ratio of contribution to sales. It indicates the contribution earned per rupee of sales. The contribution is the portion of sales revenue that is not consumed by variable costs and therefore contributes to the coverage of fixed costs and profit.

The P/V Ratio (Profit/Volume Ratio) measures how much contribution is earned per rupee of sales. When given profit figures and sales figures for two periods, the P/V ratio can be calculated using the formula:

P/V Ratio

= ( Change in Profit / Change in Sales ) × 100

= ( Δ Profit / Δ Sales ) x 100

🔹 Components:

-

Sales: Total revenue earned by the business.

-

Variable Cost: Costs that vary directly with the level of output or sales.

-

Contribution: The amount remaining from sales after covering variable costs; it contributes toward covering fixed costs and generating profit.

🔹 Interpretation:

-

A higher P/V ratio indicates better profitability, as a greater portion of each sales rupee contributes to fixed costs and profits.

-

A low P/V ratio suggests high variable costs and weaker profit generation per unit of sales.

🔹 Importance of P/V Ratio:

-

Profit Planning: Helps in estimating the level of sales required to achieve a desired profit.

-

Break-even Analysis: A higher P/V ratio implies a lower break-even point.

-

Decision Making: Used in making decisions about product pricing, mix, and cost control.

-

Margin of Safety Analysis: Aids in assessing how much sales can drop before a business reaches break-even.

🔹 Example:

Let’s say a company has:

-

Sales = ₹5,00,000

-

Variable Costs = ₹3,00,000

Then,

This means 40% of the sales revenue contributes toward covering fixed costs and profit.