🔹 Non-Collusive Models

These models assume that firms do not cooperate or collude but act independently in their own interest.

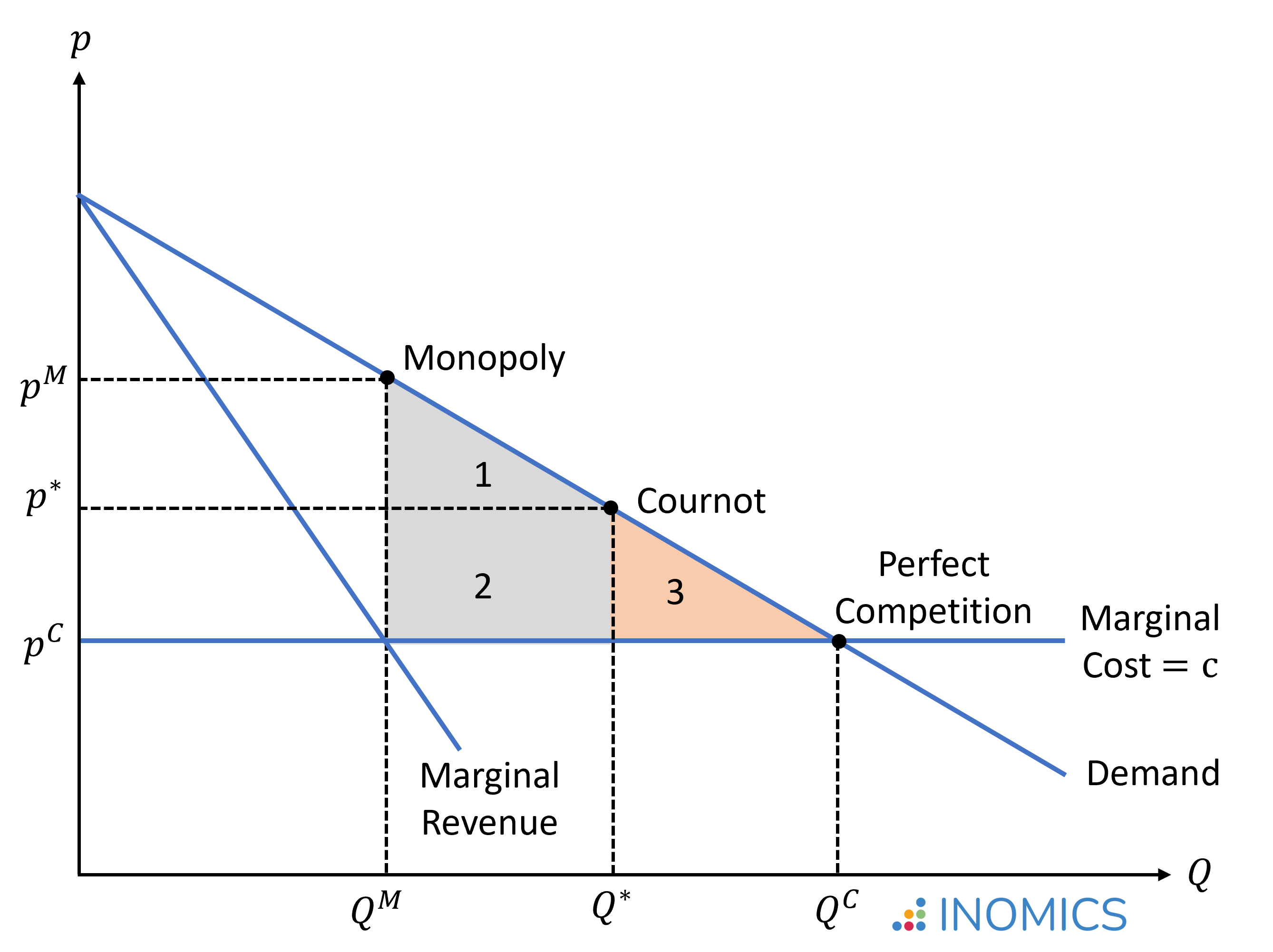

1. Cournot Model (1838)

Developed by: Augustin Cournot

Type: Quantity competition

Assumptions:

-

Few firms (n) produce a homogeneous product.

-

Firms choose output simultaneously and independently.

-

Each firm aims to maximize its own profit.

-

Market price depends on total market output.

-

No collusion among firms.

How the Cournot Model Works:

- Each firm chooses an output level, assuming the rival’s quantity is fixed.

- The market price is determined by the total quantity supplied (from both firms) based on the demand curve.

- Since each firm’s profit depends on both its own and its competitor’s output, firms adjust their quantities in response to each other’s decisions.

- The process continues until a stable Nash equilibrium is reached, where neither firm has an incentive to change its output.

Cournot Equilibrium:

At equilibrium, each firm produces the quantity that maximizes its profit given the competitor’s output level. This results in a stable market output where firms have no incentive to change their production.

2. Bertrand Model (1883)

Developed by: Joseph Bertrand

Type: Price competition

Assumptions:

-

Few firms (n) producing homogeneous products.

-

Firms set prices simultaneously and independently.

-

Consumers buy from the lowest-priced firm.

-

Perfect information and no transaction costs.

Outcome:

-

Firms undercut each other’s prices until price = marginal cost.

-

Known as the Bertrand Paradox: even with few firms, the outcome resembles perfect competition.

-

Assumes no product differentiation.

3. Stackelberg Model

Developed by: Heinrich von Stackelberg

Type: Quantity competition with sequential moves

Assumptions:

-

Two firms: Leader and Follower.

-

The leader sets output first; the follower responds after observing the leader’s decision.

-

Firms produce homogeneous products.

-

Goal is profit maximization.

Outcome:

-

The leader has first-mover advantage and earns higher profits.

-

The follower reacts optimally based on the leader’s choice.

-

Total market output is higher than Cournot, but less than perfect competition.

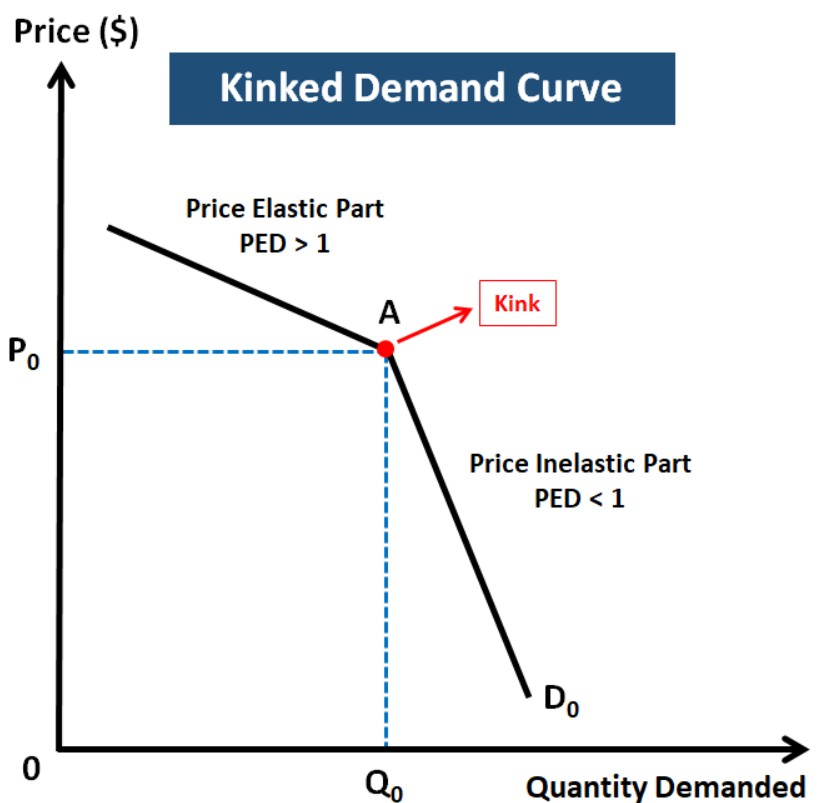

4. Sweezy’s Kinked Demand Curve Model (1939)

Developed by: Paul Sweezy

Focus: Price rigidity in oligopoly

Assumptions:

-

Few firms produce homogeneous products.

-

If a firm raises price, others do not follow → loss of market share.

-

If a firm lowers price, others follow → no real gain in share.

Outcome:

-

Creates a kink in the demand curve at the current price.

-

Demand curve is:

-

Elastic above the kink (price increase → large loss in demand)

-

Inelastic below the kink (price decrease → little gain)

-

-

Result: Price stability, even without collusion.