Break-Even Point (BEP) is the level of sales or output at which total revenue equals total costs, resulting in zero profit and zero loss. It is a critical financial metric used in cost-volume-profit (CVP) analysis to determine the minimum level of sales needed to cover all fixed and variable costs.

🔹 Definition:

Break-Even Point is the point at which Total Revenue = Total Cost, and the business makes no profit, no loss.

🔹 Formula:

There are two main formulas to calculate the BEP:

1. In Units:

2. In Sales Value:

| Option | Formula | Description |

|---|---|---|

| A | B.E.P. = Fixed Cost / P/V Ratio | Break-even sales in ₹ using contribution ratio |

| B | B.E.P. = Fixed Cost / [1 – (Variable Cost / Sales)] | Alternate form using sales and variable cost |

| D | B.E.P. = Fixed Cost / Contribution per Unit | Break-even point in units |

| E | B.E.P. = Actual Sales – Margin of Safety | Rearranged formula using margin of safety |

🔹 Key Concepts:

-

Fixed Costs: Costs that do not change with the level of production (e.g., rent, salaries).

-

Variable Costs: Costs that change in proportion to the output (e.g., raw materials).

-

Contribution per Unit: Selling Price – Variable Cost per unit.

-

P/V Ratio: Contribution / Sales × 100

🔹 Example:

Let’s assume:

-

Fixed Costs = ₹1,00,000

-

Selling Price per unit = ₹50

-

Variable Cost per unit = ₹30

-

Contribution per unit = ₹20

So, the company must sell 5,000 units to break even.

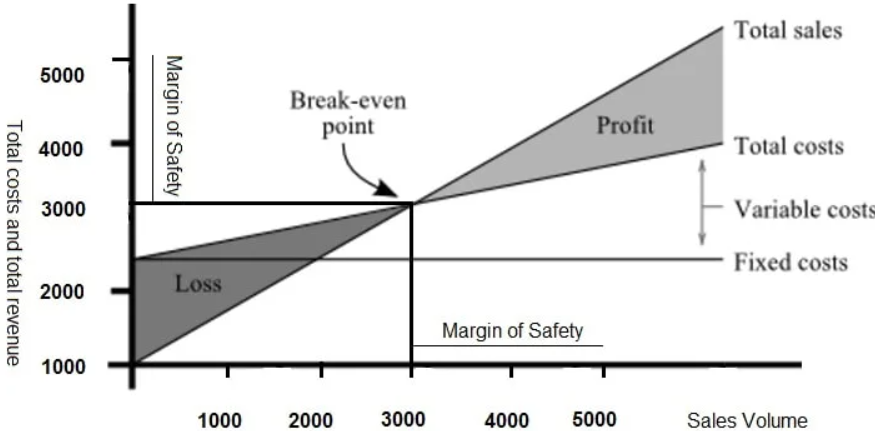

🔹 Graphical Representation:

In a Break-Even Chart:

-

The X-axis represents the number of units or sales value.

-

The Y-axis represents revenue and costs.

-

The Break-Even Point is where the Total Cost Line intersects the Total Revenue Line.

🔹 Importance of Break-Even Analysis:

-

Profit Planning: Identifies the minimum performance needed to avoid losses.

-

Pricing Decisions: Helps determine the effect of pricing on profitability.

-

Cost Control: Aids in managing and reducing fixed and variable costs.

-

Investment Evaluation: Assesses the viability of launching a new product or entering a new market.

-

Margin of Safety Calculation: Tells how much sales can drop before incurring a loss.

🔹 Margin of Safety (MOS):

Once the break-even point is crossed, every additional sale contributes to profit. The margin of safety shows how much sales exceed the break-even point:

✅ Final Summary:

The Break-Even Point is a foundational financial metric that tells a business the exact volume of sales required to cover all costs and begin making profit. It plays a vital role in decision-making, risk analysis, and strategic planning.

Law of Diminishing Returns

✅ Definition

The Law of Diminishing Returns, also called the Law of Diminishing Marginal Returns, states that:

As additional units of a variable input (e.g., labor) are added to a fixed input (e.g., land or capital), the marginal product of the variable input will eventually decline, holding all other inputs constant.

In simpler terms, after a certain point, adding more of one input while keeping others fixed results in smaller and smaller increases in output.

✅ Assumptions

-

Only one input is variable (e.g., labor); all others are fixed (e.g., land, machinery).

-

Technology remains constant.

-

Input units are homogeneous (each additional unit is of the same quality).

-

It applies in the short run, where at least one factor is fixed.

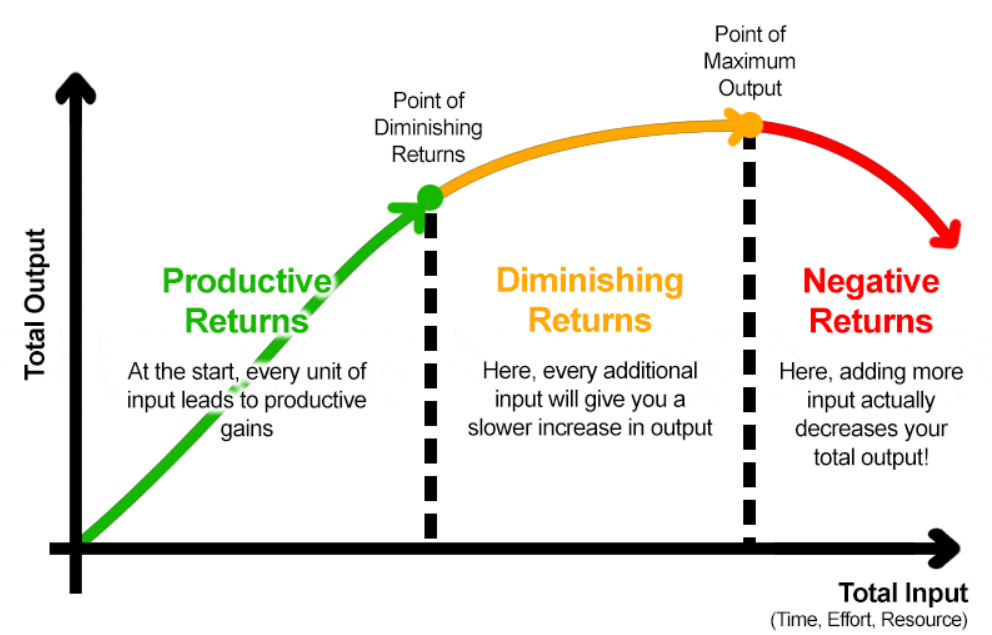

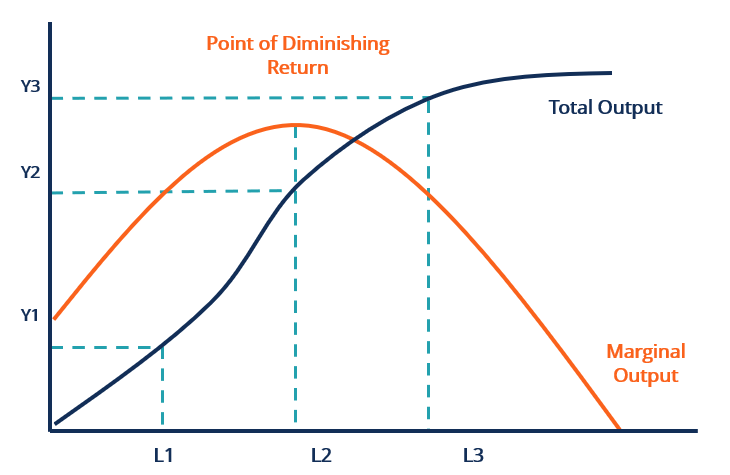

✅ Graphical Representation

In a production graph:

-

The Total Product (TP) curve increases, but at a decreasing rate.

-

The Marginal Product (MP) curve rises initially, reaches a peak, then declines and may become negative.

✅ Conclusion

The Law of Diminishing Returns highlights an important constraint in production: when one input is increased while others are fixed, there comes a point when the productivity of the added input begins to fall. Recognizing this helps businesses allocate resources more efficiently and avoid wasteful input use.