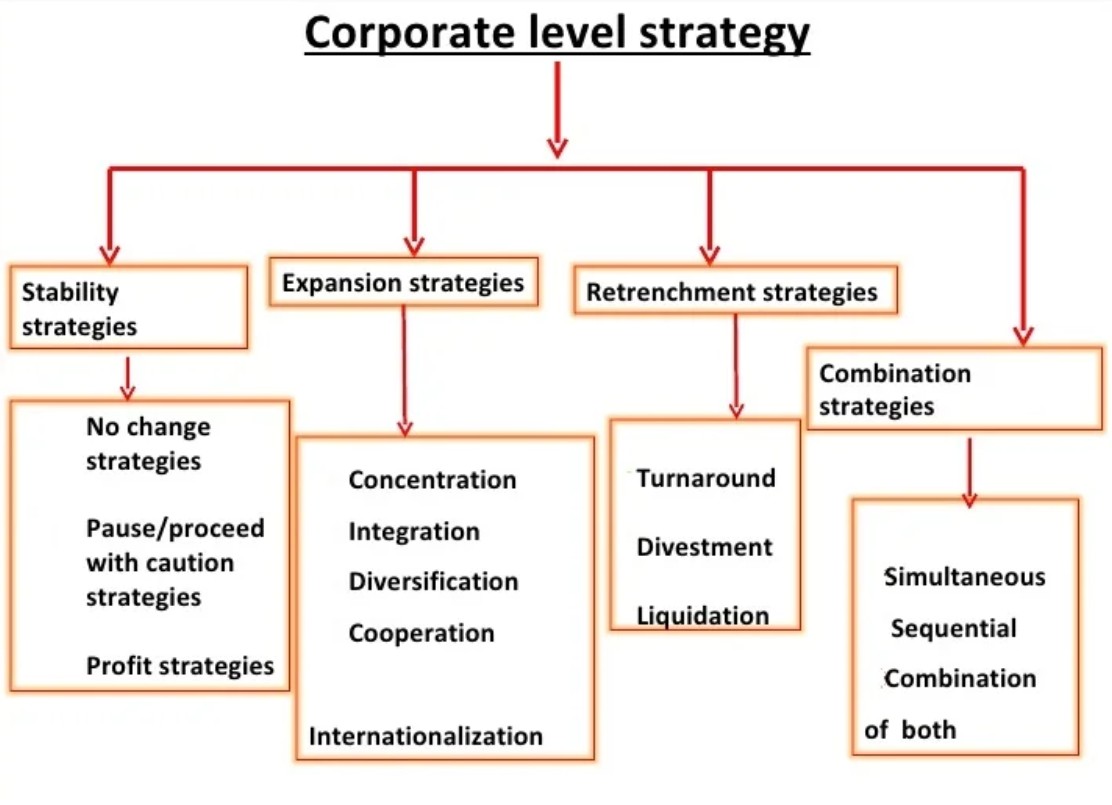

🎯 Directional Corporate-Level Strategy:

1. Concentration Strategies

-

Definition: Focus on a single business or industry to strengthen the company’s position in that particular market.

-

Goal: Grow by increasing market share, improving products, or expanding the customer base within the current industry.

-

How:

-

Market penetration (selling more to existing customers).

-

Market development (entering new geographic areas).

-

Product development (introducing new or improved products).

-

-

Example: A smartphone company focusing only on enhancing its smartphone models instead of diversifying.

2. Retrenchment Strategies

-

Definition: Reduce the company’s scope or size to improve financial stability or focus on core areas.

-

Goal: Cut costs, improve efficiency, and stabilize the company during tough times.

-

Example: Nokia selling its mobile phone division to focus on network infrastructure.

- The reasons for pursuing a retrenchment strategy typically include:

- Better opportunities in the environment are perceived elsewhere – Companies may focus on core competencies and exit underperforming areas.

- The environment is seen so threatening that internal strengths are insufficient to meet the challenge – When external threats are significant, retrenchment allows firms to protect resources and avoid further losses.

- The firm is not doing well or perceives itself as doing poorly – Retrenchment helps to address weaknesses and stabilize the company.

-

Types:

-

Turnaround (revive a struggling business)

-

Divestiture (sell off parts of the business).

-

Liquidation (close and sell assets of the business).

-

Downsizing (reduce workforce or operations).

-

3. Simultaneous and Sequential Strategies

-

Simultaneous Strategies:

-

The company pursues multiple strategies at the same time across different business units or markets.

-

Example: A conglomerate growing some businesses (growth strategy) while downsizing others (retrenchment strategy) simultaneously.

-

-

Sequential Strategies:

-

The company pursues strategies one after another in a planned sequence.

-

Example: A company might first stabilize its current operations (stability strategy), then invest in growth afterward.

-

4. Stability Strategies

-

Definition: Maintain the current business operations without significant change.

-

Goal: Consolidate and strengthen existing operations, avoid risk, and preserve current market position.

-

When used:

-

In mature industries with little growth.

-

When external conditions are uncertain or unfavorable.

-

When the company is performing well and wants to avoid unnecessary risks.

-

-

Example: A utility company continuing to operate its existing services without expanding or contracting.