The Parenting Fit Matrix is a strategic management tool developed by Michael Goold, Andrew Campbell, Marcus Alexander to help corporate parents (i.e., headquarters of diversified firms) assess how well they can add value to the different business units (SBUs – Strategic Business Units) they own.

It focuses on the concept of “parenting advantage,” which means a corporate parent should only own businesses where it can add more value than any other potential owner.

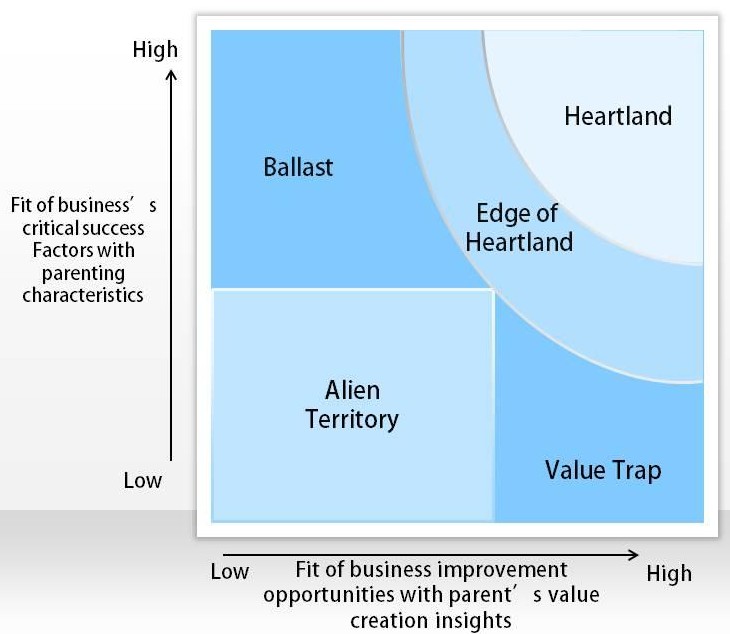

📊 Structure of the Parenting Fit Matrix

The matrix has two axes:

-

Fit with the Parent’s Skills and Resources (Vertical axis):

-

Does the business align with the corporate parent’s capabilities (e.g., management style, systems, expertise)?

-

How well can the parent understand and support the business?

-

-

Misfit Risk or “Feel” Misfit (Horizontal axis):

-

Does the parent understand the business culture and local needs?

-

Is there a risk that the parent’s involvement might harm the business?

-

🧩 The 5 Positions in the Parenting Fit Matrix

| Position | Description |

|---|---|

| Heartland Businesses | ✅ These businesses are a perfect fit. The parent understands them well, and its involvement adds clear value without disrupting operations. These are core businesses that should be grown and supported. |

| Edge of Heartland | ⚠️ These businesses are close to being a good fit. With some effort or adaptation, the parent can add value, but it may not be immediate. Careful management is needed. |

| Ballast Businesses | ⚙️ These businesses run well on their own, but the parent can’t add much value. They’re typically stable and low-risk. Retaining them is fine, but active parenting isn’t necessary. |

| Alien Territory | ❌ These businesses are completely misaligned with the parent’s skills, understanding, or culture. The parent risks damaging them through interference. These are strong candidates for divestment. |

| Value Trap | 🚨 These businesses seem attractive, and the parent believes it can add value—but in reality, they don’t fit well and may lead to wasted resources or strategic failure. High risk of overconfidence. |

📌 Example

Let’s say a large consumer goods company (like Unilever) owns:

-

A cosmetics brand → fits their expertise → Heartland

-

A logistics company → they don’t know much about logistics → Alien Territory

-

A household cleaning brand that operates efficiently already → Ballast

-

A tech startup they think they can help but don’t really understand → Value Trap

✅ Summary

| Matrix Position | Strategic Advice |

|---|---|

| Heartland | Invest and actively manage |

| Edge of Heartland | Monitor and develop cautiously |

| Ballast | Maintain but don’t interfere |

| Alien Territory | Divest or avoid |

| Value Trap | Reassess or avoid overcommitment |